Meeting With Investors: 11 Tips To Prepare For It

Don't be intimidated for your next investor meeting by following our 11 expert tips and putting your best foot forward.

If only you could wake up one day and have all the money in the world to fund your dream business idea. Unfortunately, funding a startup is never quite that easy. You can dip into your savings or ask for money from friends and family, but investors come with more experience, resources, and most importantly, access to more capital. These angel investors and venture capitalists will want to sit with you for an investor meeting to decide whether you’re a good investment or not. Here’s how you can hold a successful meeting with potential investors.

What is an investor meeting?

An investor meeting is a presentation of your business idea to a venture capitalist or angel investor in hopes of obtaining their funding. These meetings are increasingly foundational to startup success: Every year, tens of thousands of small businesses are funded by investors who see potential in their business. According to angel investor Basil Peters’ Angel Blog, angel investors and venture capitalists respectively fund 16,000 and 600 businesses per year.

Long after you secure your funding, you can also expect to hold regular meetings with your investors. These meetings typically cover how your company is performing, future plans and projections, and how the invested money is being spent. Hoover, for purposes of this article, we’ll focus on that initial meeting to secure your funding.

11 tips on how to prepare for an investor meeting

As you prepare to meet with a potential investor, keep these 11 tips for success in mind:

- Perfect your business plan

- Have your pitch deck ready

- Share your financial statements

- Understand your market size

- Make the right first impression

- Consider the questions you’ll be asked

- Remain open to criticism

- Know what you know

- Know what makes you comfortable

- Research your investor

1 Perfect your business plan

Your business plan details how your business idea turns into a profitable operation. It explains the strategies you’ll implement to grow and succeed, as well as how much capital you expect to spend on each portion. For someone to put money into your business, they’ll need to be confident it will succeed, and your business plan states your case.

2 Have your pitch deck ready for investors

Your pitch deck includes sections detailing your vision, current traction, market opportunities, revenue potential, who’s on your team, competitor research and how you stand out, and more. All these sections should go beyond stating facts and instead should build a narrative around your startup. Combined, a story and a solid set of data can prove quite persuasive. When you make a pitch deck, focus on creating a compelling narrative supported by strong data.

Come meeting time, you’ll want to print one copy of your pitch deck for each person in the room. You should also send your pitch deck to all attendees before the meeting so they can review it ahead of time. If you’re preparing an agenda for the investor meeting, this should be sent along as well. Your pitch deck teaser can help potential investors come up with questions beforehand, and your printed deck will make your presentation easier to follow. A more productive investor meeting is likely to result.

3 Share your financial statements

Your business plan and pitch deck should contain information about how you expect your operations to turn a profit. You’ll need to back up these ideas with the numbers that financial statements provide. Investors will want to see how much you’re spending, your projected costs, and your plans for spending their invested funds. Include your current assets, liabilities, and net worth while forecasting how these numbers will differ one, three, and five years from now. Alongside this projection, you should detail your monthly financial plans for the near future.

Once you have these numbers set, you can show your potential investors how their funds could affect your projections. If your calculations don’t show profits for your potential investors, they won’t fund you. You’ll need to spend significant time showing how the investment funds will benefit both you and the people investing this money. You might even want to create a second financial plan in case the first proves unpersuasive.

4 Understand your market size, competitors, and industry

A brilliant idea can flounder in execution if another company has great success with a similar model. Investors know this and expect business owners like yourself to present extensive competitor research. You should explain how you differ from competitors and how you can succeed in your industry despite the obvious presence of another big player.

5 Make the right first impression

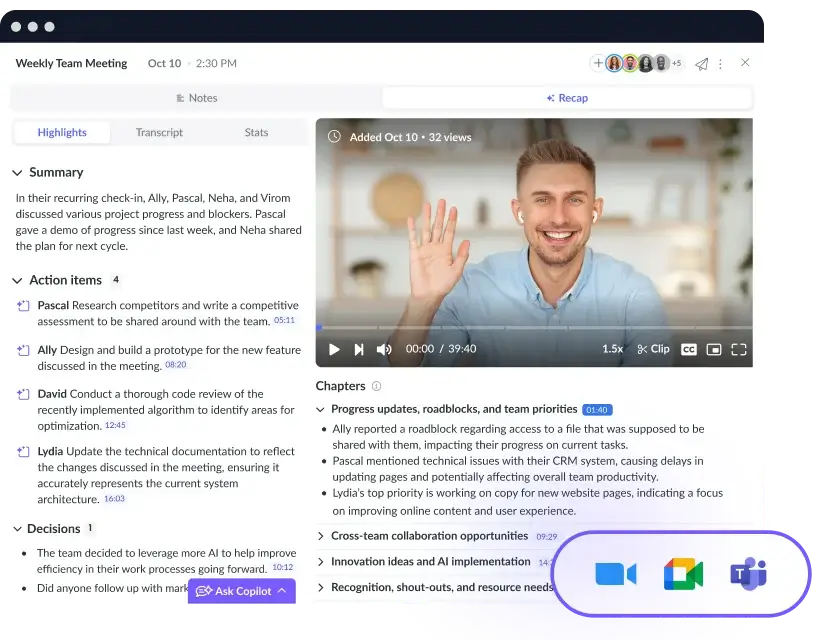

These first four tips produce the documents you need for your investor meeting, but the next step is delivering this information during the meeting itself. Think about what may impress your investors and what may rub them the wrong way. Focus on naturally and genuinely incorporating those impressive traits from the moment you first shake hands with your potential investors. Part of making the right first impression includes involves being prepared and organized within your presentation and documentation. To do so, use a meeting software like Fellow.

As you prepare to make this first impression, consider these pointers:

- Arrive a few minutes early so you have time to catch your breath and process your thoughts.

- Change into your meeting outfit.

- Maintain an enthusiastic, approachable tone throughout your meeting, even though challenging questions.

6 Consider the questions you’ll be asked

Surely, you understand that investors have to be careful with their money. Needless to say, they’re going to ask a lot of questions. The good news for you is that these questions often fall into the same categories, so you can prepare satisfactory answers ahead of time.

Expect to be asked about how your startup solves a certain problem better than its competitors. You should also prepare for questions about your growth potential, the qualifications of you and your team, and your traction to date. You might also hear questions about the difference the investor’s funds will make in your plans. Know your answers to these questions in advance so you’re not caught off-guard.

7 Remain open to criticism

Most investors have been doing this for a while. They have experience with what does and doesn’t work. So instead of getting defensive amid criticism, take your investor’s comments as opportunities for improvement. For example, maybe the investor thinks you could classify your team’s roles differently or believes you should add new key roles, such as a Chief Marketing Officer. Consider their advice – it comes from experience.

8 Know what you know – and what you don’t know

Investor criticism will often come from the investor knowing something you don’t. It’s a bad look to presume that your experience or knowledge invalidates the investor’s perspective. Instead, accept that your investor has more expertise in the area under discussion and outwardly show your gratitude for their perspective. Showing humility and a clear ability to listen makes you a far better investment than a stubborn know-it-all who can’t take advice.

9 Know what makes you comfortable

If you’re working with venture capitalists, you’ll likely trade a stake in your business for the funding you seek. How big this share can be is up to you. If an investor asks for a 30% share and you’re only comfortable with 20%, say so up front. You might lose the deal, but would you have been happy with it in the first place? Probably not.

10 Research your investor

In pitching investors, you might be tempted to focus solely on you and your business. Although that logic makes sense, the best pitches show due diligence regarding both yourself and the entities that may fund you. That means you should research your investor and demonstrate what you know about them during your meeting. No, don’t rattle off a laundry list of facts about the investor, but do tie their interests and style to key parts of your presentation.

For example, let’s say your crypto startup is meeting with an investor known for funding green companies. In this case, when discussing your company’s standout feature of making crypto eco-friendly, you can mention the investor’s history in green investments and tie it to your company’s mission and specific action points, such as migrating to renewable energy. Doing so ties your presentation to the investor’s interests and shows them you’re looking for both their money and their vision. That human touch can help you seal the deal.

11 Remember to follow up after the meeting

Once all is said and done, sending a “thank you” message to the meeting’s participants is an excellent final touch. You can include a summary of the meeting in your email, which includes the meeting’s agenda, any notes, follow-up questions, and next steps. Fellow’s guest users tool can help organize those notes, follow-up points, and next steps while demonstrating your ability to pay attention to detail.

Investor meetings are just that: meetings

Investor meetings can be intimidating. After all, there’s a lot of money on the table, and people who can offer that much money can make for quite imposing figures. But at the end of the day, an investor meeting is, like any other meeting, a conversation among people. By following these 11 tips, preparing for a productive and successful investor meeting ensures you’re putting your best foot forward for this important opportunity.