The Most Common Small Business Problems (& Solutions)

Knowing what business problems to solve can help you stay ahead of the competition! Learn 6 popular small business problems and solutions.

Small businesses are a big supplier of jobs and innovation, making them vital for our economy. In fact, nearly half of the people in the United States are employed by a small business! Yet, small businesses are incredibly fragile. While 80% of small businesses will survive the first two years, only 25% actually make it to the 10-year mark. If you’re a small business owner looking to make your company part of the 25%, you’ll need to build a strong understanding of common problems facing your team and the best ways to solve or mitigate those concerns!

6 popular small business problems and solutions

- Hiring quality employees

- Retaining talent

- Managing workflow

- Defining a company culture

- Dealing with inflation

- Managing cash flow

1Hiring quality employees

Hiring the wrong employees is expensive. In fact, the cost is expected to be around $15,000 per bad hire. Some of these costs include additional training, having other employees review or redo work, and expenditures that don’t generate sufficient return on investment (ROI). Poor-quality employees can become underperformers who either aren’t qualified to do the job or are not interested in doing it anymore. Underperforming employees also run the risk of slowing down or demotivating other team members. Candidates who are a poor fit for the role are also likely to quit within six months, making hiring costs much more expensive.

Solution: Have hiring processes

Knowing how to hire high-quality employees is tough, especially if you’re new to hiring or you’re hiring for an entry-level role. But through building defined hiring processes, you can take a structured approach to securing great talent. To do this, you need a comprehensive idea of what the job realistically entails. This helps you get applicants who are aligned with the real day-to-day responsibilities of the new role. When creating your hiring process, determine what your requirements are and the proof of experience you want to see from each candidate, what steps are involved (like interviews), and what will be the top deciding factor to break a tie between two great potential hires. Candidates also like to see your hiring process in writing so they know what to expect when it comes to timelines and next steps.

2Retaining talent

Once you’ve got a great hire in the door, there’s still a risk of losing them. Top performers can decide to quit for a lot of reasons, including when they:

- Have managers who aren’t consistent or responsive to their needs

- Don’t have well-defined expectations set by management

- Are not being promoted or earning raises appropriate to their performance

- Are being micromanaged

- Are no longer challenged in their role

- Are experiencing burnout or are at risk of experiencing burnout

- Regularly receive destructive feedback

Solution: Offer competitive benefits

Retaining your top performers should be a top priority. To proactively identify any issues that might be bothering your employees, you can run an employee engagement survey 1-2 times throughout the year. Based on the results, identify what workplace benefits would make your company a great place for your top performers, and then get started on implementing them! Benefits can range from anything like performance bonuses, stock options, extended health insurance coverage, regular promotion opportunities, mentorship, free meals, or additional paid time off (PTO).

3Managing workflow

Throughout the day, a lot of tasks will land on your desk. Incorrectly prioritizing projects can create delays and bottlenecks that ultimately lead to lost revenue. Similarly, not having a defined process or designated person for handling specific activities can lead to tasks being forgotten. Projects can also fail due to poor workflow management issues like a lack of quality assurance (QA), inadequate planning and scheduling, a lack of clear requirements, or failure to require accountability for results.

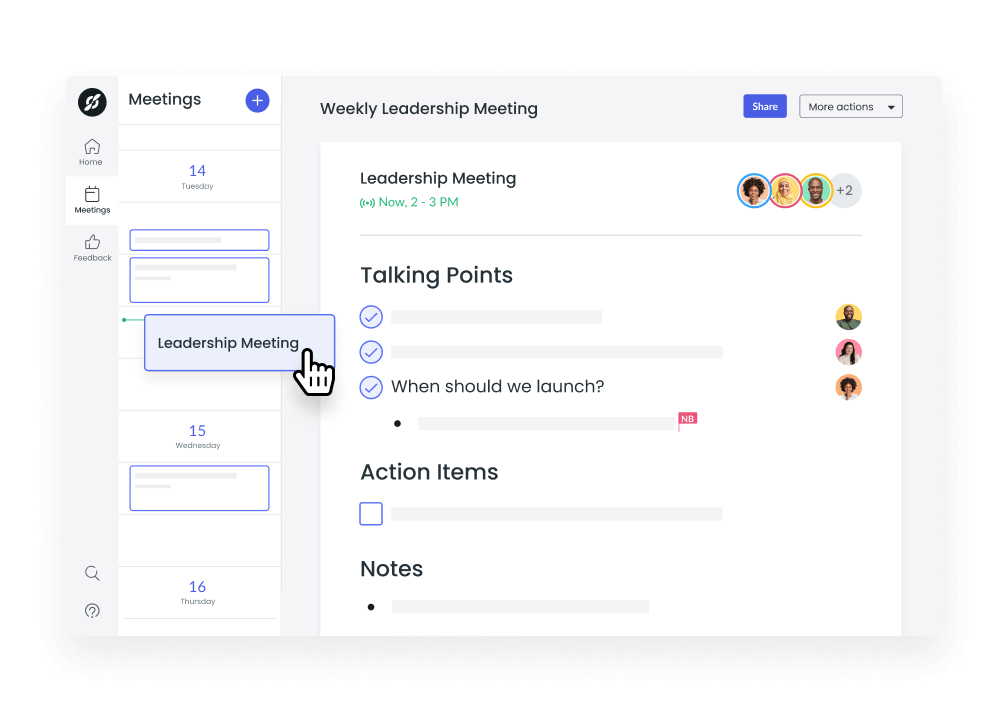

Solution: Have good processes in place

Use organizational software like Fellow to communicate goals and requirements with your team. Start by creating a collaborative meeting agenda that outlines the goal of the meeting and the most important task (MIT). In your meeting, assign meeting roles so that you have a clear understanding of who will be responsible for tracking action items, taking meeting notes, making decisions, etc. Defining these go-to people ahead of time will make overcoming blockers much easier in the future. Plus, with Fellow’s long list of integrations, you can quickly and easily link an action item to tools you already love using. Once linked, the item status, due date, and assignee will stay in sync between both tools. No need to duplicate work!

Streamline your workflows

Enhance productivity and collaboration with centralized and organized important information, tasks, and communication in one place. Say goodbye to scattered documents and emails, and say hello to a seamless workflow with Fellow!

4Defining a company culture

Company culture is made up of the values, mission, and everyday behavior of employees in the organization. It is so important to employees that 3 in 5 Americans would actually take a 50% pay cut if it allowed them to move to a job they loved. Where a lot of companies go wrong is that they don’t define a specific culture, so they end up hiring a mix of employees who all share different values. And when teams aren’t aligned on shared values, the likelihood of miscommunications, tension, and destructive feedback rises.

Solution: Lead by example

No matter what type of company culture you’re striving for, it won’t happen easily or overnight. Since company culture is deeply ingrained in the everyday behaviors of a company’s employees, leaders need to be role models for the ideal type of culture that the company wants to adopt. It will also help if the envisioned culture is documented in writing and saved in a shared space for team members to access. Maintaining transparency and honesty while practicing your company culture will allow you to get clear feedback from employees about what they like or don’t like, which will also improve your retention rates!

5Dealing with inflation

There’s no doubt that the economy plays a role in every business’ success or failure. Inflation was incredibly high in 2022 with a peak at 6.2%. High rates combined with uncertainty about how inflation will look in future years are enough to set any business owner on edge. Some negative impacts of overly high inflation include:

- The increased cost of goods and services

- The increased tension between employees and management if pay raises are not met

- The possibility of layoffs

- The need to adjust your own pricing, which can cause difficult interactions with customers

Solution: Reduce unnecessary spend

It’s important to be cognizant of which expenditures actually generate value for your organization. Start by reviewing all of your subscriptions to see if any can be canceled. For example, if you have two software products with similar features, it would be wise to cancel the one that is least valuable (or the hardest to use) for your team.

You might also want to take a look at how your employees spend their time. Calculating the ROI of your meetings will give you a quantifiable way to determine how expensive every meeting is, which is a starting point for making effective use of your collaboration time. A quick win is going into every meeting with a specific purpose to ensure your time is spent productively!

6Managing cash flow

With economic uncertainty and inflation issues also come cash flow concerns. Small businesses have less capital and often less internal knowledge about how to budget, forecast, and manage accounts. Cash flow issues can also be caused by poor inventory management, seasonal changes in demand, expensive borrowing, failure to set up emergency funds, or coming up short on revenue growth goals. For investor-backed companies, cash flow might not seem like as big of an issue at the moment, but failure to build healthy spending habits can put your business at risk down the line.

Solution: Prioritize cash flow initiatives

When prioritizing your work, focus first on activities that will generate direct revenue. Departments like sales, marketing, and customer success will be the most equipped to handle short-term revenue generation campaigns, but it’s important not to forget about long-term growth. Aligning your revenue-generation departments with other teams like product development, finance, and operations can ensure that you’ll have revenue growth down the road, too.

As a small business, building great money habits early is important. Get some financial advice about how to set up your spending accounts, track income and expenses, and forecast expected future revenue. Accurate reporting and planning in your early days will be a huge support as your company grows!

Parting advice

Being a small business owner is no easy job. But equipping yourself with the knowledge of common business problems to solve will keep you focused on foundational elements for a strong, stable, and long-lasting company. As you grow, it’s essential to maintain open feedback loops with your team so you can continuously pull new insights on how to improve your business. In practice, Fellow can facilitate giving and receiving feedback across your team and keep everyone aligned on common growth goals!