Monthly Budget Review Meeting Template

Get this templateRun structured and effective budgeting meetings with our Monthly Budget Review Meeting Template. Tailored for business stakeholders, this template includes opportunities to review the budget, assess financial health, and update all stakeholders. Use this template in Fellow to add talking points, embed relevant documents, and track action items

Monthly Budget Review Meeting Template

A monthly review meeting is an important time for business stakeholders to come together to determine the company’s financial goals, where they are spending money, and any upcoming expenses that may impact their budget going forward. This meeting should follow a monthly review meeting format to ensure that it is conducted thoroughly and gathers all necessary decision-making information.

What is a Monthly Budget Review Meeting?

A monthly budget review meeting creates an opportunity for stakeholders to come together to discuss the company’s budget and make adjustments as needed. Having a budget meeting agenda helps ensure that all necessary topics are covered while also ensuring that the meeting stays on topic. A monthly budget meeting is sometimes aggressive in that many organizations only host a quarterly review. However, in businesses with limited budgets as well as organizations that may have concerns, a more frequent review is beneficial.

The Purpose of a Monthly Review Meeting

The monthly budget review meeting analyzes how the company is performing financially within the current and projected budget. Stakeholders are able to share their specific concerns. This allows for the updating of other stakeholders. These meetings may be attended by anyone that has oversight of the financials, including CFOs, bookkeepers, as well as planners, and account managers.

These meetings are important because they ensure capital and cash flow are adequate and that the business is working to ensure the best possible financial oversight. A monthly finance meeting agenda helps ensure the group is staying on task.

The agenda itself should include any important factors impacting budgetary concerns right now. It should also allow for each department represented to discuss their areas of budget concern, including areas of potential improvement or areas of financial limitation.

To run an effective meeting, the lead needs to be organized beforehand, including any data and reports available that can provide insight. It is also important to verify all information collected to ensure it is accurate.

These meetings typically last 30 minutes to an hour, depending on the complexity of the situation. During that time, each member of the meeting should be able to present data fully without interruption. Ensure, too, that each department has clear representation on concerns, such as why projects are running over budget or what areas are lacking. That way, those issues can be addressed during the meeting itself.

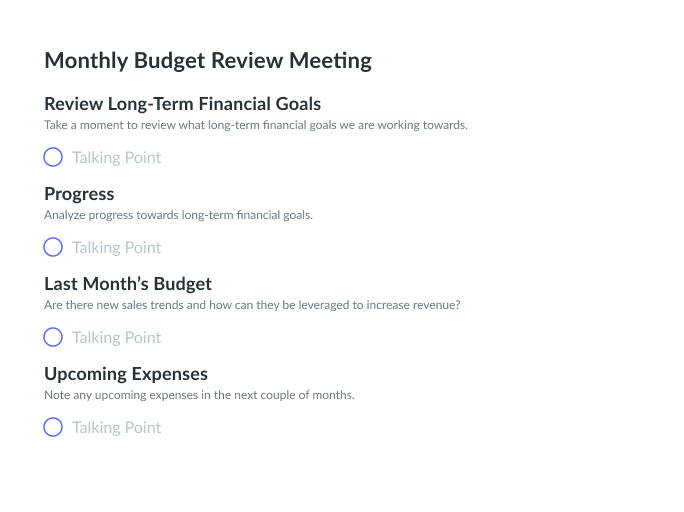

What’s inside this Monthly Budget Review Meeting Template:

Ensure that all information is available and carefully understood as you move through the monthly budget review meeting template.

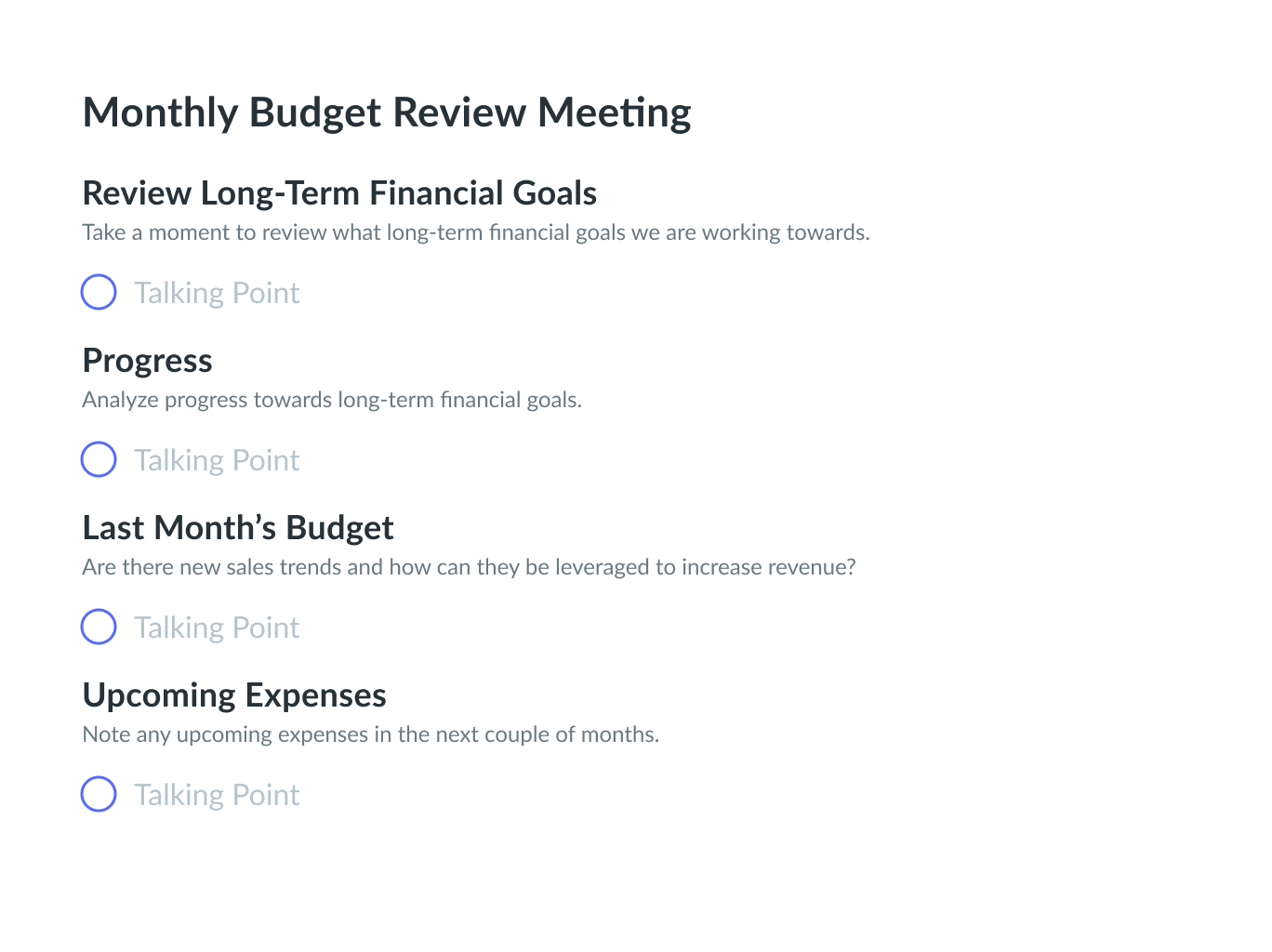

1 Review Long-Term Financial Goals

Take a moment to review what long-term financial goals we are working towards.

The initial components of the meeting should focus on reviewing the long-term, pre-established goals for the company. The specific focus here should be on where the company stands on those goals. Review what the goal is, what type of headway has been made, any limitations that may have held the company back from working towards those goals, and how viable the goals are. It may also be important to review long-term financial goals like this when changes in economic conditions or company operations exist. This may allow the organization to make decisions about changes that may be necessary or beneficial.

2 Progress

Analyze progress towards long-term financial goals.

In this section of the template, outline any goals that have been achieved. What progress was made on long-term goals? Outline the specifics in terms of dollars and cents. Discuss any limitations on what that progress may have been limited and what that could mean to the company. It helps to have gathered all documentation in advance of the meeting to ensure that this topic can be fully addressed and that the data available is accurate.

3 Last Month’s Budget

Are there new sales trends and how can they be leveraged to increase revenue?

Gather financial documentation about the previous month’s budget. Use this area of the template to discuss what is happening within the organization. For example, are there sudden and significant changes in sales trends that need to be addressed? It may be necessary to consider how new sales trends could be helpful in increasing the company’s revenue goals. Use the meeting as a way to talk about new ideas in this area but avoid straying too far from the month’s budgetary figures and why they are what they are.

4 Upcoming Expenses

Note any upcoming expenses in the next couple of months.

It is also essential to understand the upcoming expenses for the next few months. This should include a look at how accurate budgets are for the current month and if adjustments are necessary. It may also need to include a look forward to pinpoint any very high potential expenses that are coming or other adjustments that are necessary to keep the company within budget. Discuss reasons for expenses as well as long-term concerns, such as significant upgrades or changes that may be necessary to the budget to meet long-term planning for large capital improvements or other changes.